Isn’t she gorgeous?

<smile>

As usual, click for a larger view…

Friday, February 3, 2006

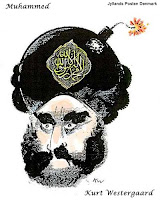

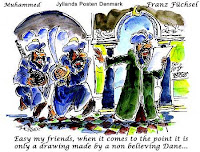

As you have probably heard on the news, some cartoons published by a Danish newspaper (Jyllands-Posten) have created quite a ruckus all over the world. It seems that some Muslims find the cartoons offensive, and they’ve reacted with anything from condemnation to organized boycotts to threats of violence. And the reaction of the MSM — worldwide, almost without exception — is to cave in to the Muslim demands by refraining from publishing these cartoons. This response, from a media that doesn’t hesitate in the slightest to publish images or movies that are offensive to Christians or Jews. Interesting bit of hypocrisy, that…

Can you imagine the MSM reaction if (let’s say) a Christian group threatened to burn down a newspaper’s offices and to kill its reporters because it published a Maplethorpe photo? Or the MSM reaction if thousands of Jews worldwide demonstrated demanding the execution of Danish politicians because a Danish newspaper ran cartoons mocking God? You know that isn’t going to happen, and you know darned well the MSM would react by running more such images — and not by caving in. But look at them with these cartoons! It’s disgusting and depressing to watch them so humiliate and debase themselves. The rare exceptions are heartening, but even those are proving short-lived (as in the French newspaper that published the cartoons, but then fired their editor the next day).

Michelle Malkin and Ed Morrisey have excellent coverage and commentary.

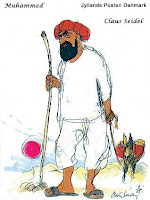

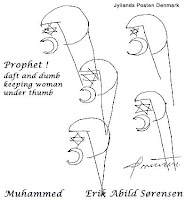

If you’re curious what’s actually causing the flap, here are the cartoons so you can see for yourself:

Way back when, in 2003, Bush’s package of tax reductions passed. One of the most controversial of these was the reduction of capital gains taxes from 20% to 15% — a hefty and very welcome 25% rate reduction.

You may recall the furious response from the liberals (Democrats, for the most part): red-faced, vein-bulging rhetoric about how the Bush administration was handing out favors to its rich patrons (as if the rest of us don’t pay capital gains tax!). Most especially the liberals screamed about how the tax revenues would decline, creating a larger deficit.

Well, guess what? The Congressional Budget Office (CBO) reported yesterday that federal revenues from capital gains taxes are up by 45% since the tax reduction took effect. Up, not down as the liberals predicted. Up, as the economists and supply-siders predicted. Up, not down as the MSM confidently predicted (the New York Times editorials, especially).

Now some of the increase certainly comes from increased average stock valuations since 2003 — but that increase only accounts for a fraction of the increased tax revenues. The rest of it comes from the dynamic and adaptive capital markets, where stock owners quickly figured out that when taxes are lower, selling stock makes sense in many more situations than otherwise. In other words, the old, higher tax rates encouraged investors not to sell one stock and buy another (and this is where the taxable event occurs), and the lower tax reduces that effect. A lot. So much so that while the tax rate was lower, so much more stock turned over that overall taxes collected were higher.

Any shopkeeper or businessman can identify with this observation, because it is just another manifestation of a maxim of capitalism: lower prices mean increased demand. And by lowering the capital tax rate, the federal government effectively lowered the price of every long-term stock transaction — so the demand for those transactions increased.

Does this seem obvious to you? It does to me. But year after year, the Democrats (along with some Republicans!) insist on static analysis of tax changes — meaning that they refuse to take market effects into account when forecasting the result of a tax increase or decrease. And year after year they are proved wrong. Many tax rate increases have resulted in lower tax revenues, and vice versa. The examples are numerous, and yet these dinosaurs insist on static analysis. Why is this?

I can only think of two reasons why: either our politicians are all awesomely stupid, or there is political advantage in static analysis.

So is there a political advantage in static analysis? If so, I can’t find it. How is it to either party’s advantage to be wrong about tax revenue forecasts? From the Democratic perspective, if you assume (as I must, from observation) that their objective is to extract as much money as possible from the American taxpayer, then you would think that they would be best served by finding the “sweet spot” in the tax rate that resulted in the most tax revenues. For capital gains, that’s clearly somewhere south of 20%, and (I suspect) south of 15% as well. You’d think that the Democrats would be jumping for joy at the effects of the capital gains tax reductions, as their most fevered dreams are coming true: more and more money is being extracted from those “rich” taxpayers. But in fact they are lamenting the reduction of the tax rate, and they would like to see it go back up to 20% — or even higher, if you listen to the likes of Kennedy or Kerry. Even though the higher tax rate would lead to lower tax revenues.

Sigh.